Liquidity Trap? Currency crisis?

Remember the term 'liquidity trap' from your Eco 100 discussion of the Great Depression?

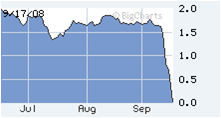

Paul Krugman fears we might be entering one right about now.. based upon amongst other things, the sudden one day dive in yields on US treasuries:

Paul Krugman fears we might be entering one right about now.. based upon amongst other things, the sudden one day dive in yields on US treasuries:

This suggests investors flight to safe investments even if they yield very little at all, which in turn clearly signals their lack of interest in making most other types of loans that would normally be part of the money creation process. In such situations the Federal Reserve loses their ability to control the money supply.

update 9/18: Paul Krugman checks the markets again this morning and finds that the return on the three month treasury is negative! People are willing to pay $100 today for a treasury bill that pays less than $100 in three months time! As he points out, this didn't even happen in the Great Depression. No surprise then to hear this 3am announcement that "the world's biggest central banks planned to pump $247 billion into the financial system..."

update 9/18: Paul Krugman checks the markets again this morning and finds that the return on the three month treasury is negative! People are willing to pay $100 today for a treasury bill that pays less than $100 in three months time! As he points out, this didn't even happen in the Great Depression. No surprise then to hear this 3am announcement that "the world's biggest central banks planned to pump $247 billion into the financial system..."

Meanwhile, Kenneth Rogoff comments on how the present financial crisis would have unraveled were the US a developing country, and wonders how much longer we can keep on being different:

One of the most extraordinary features of the past month is the extent to which the dollar has remained immune to a once-in-a-lifetime financial crisis. If the US were an emerging market country, its exchange rate would be plummeting and interest rates on government debt would be soaring. Instead, the dollar has actually strengthened modestly, while interest rates on three- month US Treasury Bills have now reached 54-year lows. It is almost as if the more the US messes up, the more the world loves it.

But can this extraordinary vote of confidence in the dollar last?

Comments